Events

October 19, 2021

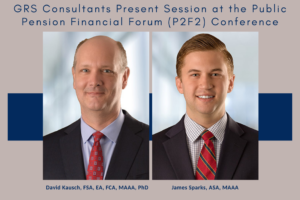

GRS Consultants Present Session at P2F2 Conference

David Kausch and James Sparks presented the session “What’s This Accounting vs. Funding Basis?” at the Public Pension Financial Forum (P2F2) virtual conference.

David Kausch and James Sparks presented the session “What’s This Accounting vs. Funding Basis?” at the Public Pension Financial Forum (P2F2) virtual conference.

Session Overview:

The discussion covered the different purposes of actuarial valuations-funding and accounting-and the similarities and differences between them. Attendees were provided with an actuarial perspective on the assumed rate of return, discount rate, actuarial cost methods, timing of recognition of gains and losses, assumption changes, plan amendments, and contribution and expense calculations.