Events

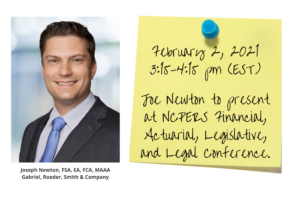

February 2, 2021

Joe Newton to Speak at the NCPERS Virtual Conference

Joe Newton will present the topic “Ensuring Sustainable Public Pension Plans – A Qualitative Approach” at the 2021 NCPERS virtual conference. The session is based on a unique checklist of qualitative factors and a star-rating method developed under Joe’s leadership. The process is designed to help retirement systems evaluate plan health more comprehensively by assessing factors such as policies, risks, and contribution history, versus merely relying on single metrics such as the funded ratio.

Joe Newton will present the topic “Ensuring Sustainable Public Pension Plans – A Qualitative Approach” at the 2021 NCPERS virtual conference. The session is based on a unique checklist of qualitative factors and a star-rating method developed under Joe’s leadership. The process is designed to help retirement systems evaluate plan health more comprehensively by assessing factors such as policies, risks, and contribution history, versus merely relying on single metrics such as the funded ratio.

The NCPERS virtual conference is being held from February 2-3, 2021. Learn more: https://www.ncpers.org/