Industry News

CRR Finds the Number of Americans Claiming Social Security at Age 62 Continues to Decline

On May 25, 2021, the Center for Retirement Research (CRR) at Boston College released its issue brief, Pre-COVID Trends in Social Security Claiming. The CRR study provides a pre-COVID baseline on Social Security benefits claiming to help assess the impact of COVID-19. Over the last 20 years, there has been a dramatic decrease for individuals age 62 claiming Social Security benefits as soon they become eligible.

Based on unpublished Social Security data, the trend shows a significant decline with only 1 in 4 claiming benefits at age 62 in 2019. Furthermore, those that delay their benefits are claiming in their mid-60s or later. By claiming later, workers’ monthly benefits will be higher and help to generally improve retirement income security.

The brief concludes, “Our reading of the early evidence is that COVID and the ensuing recession have not pushed large numbers into early retirement – perhaps because those most affected cannot afford to stop working. Regardless of the ultimate impact, COVID is not likely to permanently reverse the trend towards later claiming.”

The brief is available here.

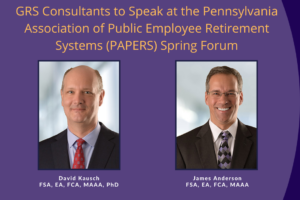

David Kausch

David Kausch