Industry News

IRS Issues Guidance on CARES Act Retirement Plan Distributions, Loans and RMDs

In June 2020, the Internal Revenue Service (IRS) issued guidance in Notices 2020-50 and 2020-51 on retirement plan distributions, loans and required minimum distributions (RMDs) as provided under the Coronavirus Aid, Relief and Economic Security (CARES) Act, enacted on March 27, 2020.

IRS Notice 2020-50 includes clarifications on the categories of individuals eligible to access the enhanced CARES Act distributions and loans. It is intended to assist employers and plan administrators, trustees and custodians, and qualified individuals in applying Section 2202 of the CARES Act. The Notice provides guidance on how plans may report coronavirus-related distributions and how individuals may report these distributions on their individual federal income tax returns.

IRS Notice 2020-51 provides guidance relating to the waiver of 2020 RMDs from certain retirement plans under Section 2203 of the CARES Act. In addition, it provides transition relief for plan administrators and payors in connection with the change in required beginning date for RMDs under Section 401(a)(9) of the Code pursuant to Section 114 of the SECURE Act.

Notice 2020-50 is available here and Notice 2020-51 is available here.

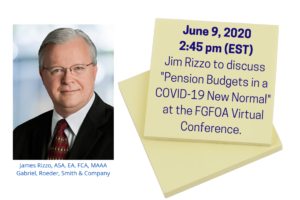

Jim Rizzo

Jim Rizzo